Every small, medium and indeed, large organisation you talk to highlight “innovation” as a key initiative. But what is innovation, and how does innovation relate to the normal finance function, especially in a fluid, management accounting environment? Is it a set of new skills that are applied on top of the old operations or existing strategic approach? Financial operations have seen many positive, subtle adaptations from other parts of the business. The big 4 talk about a lean and agile approach to finance and business in general. This is because they have been effective in manufacturing and IT environments. One can also imagine it being able to enable them to grow their consultancy services outside of existing service offerings.

Innovation is simply the adaptation of creative thought processes as they apply to new products, services and development of new business. Importantly, it is integral to combine a variety of resources to expand on the wonderful ideas that get thrown up for discussion. Finance is possibly the most important component as it determines the initial cost advantage and certainly the business planning. However, more critically, it can offer breakeven analysis that any creative team would need to understand before securing support from any stakeholder involvement. Other relevant financial data needs to be included in any presentation of a business case when endeavouring to secure funding or to fully expand concepts into a business reality. Once again, many presentations have failed when pitched because the costings just didn’t stack up. The members of the finance group are inclined to examine areas of risk that the creative members may overlook through their efforts to develop and commercialise a project.

As an example, most startups have poor or improper business case development. Therefore they are failing to convince investors that they are on to the next best thing. Why this is important for current business attitudes is that markets and business is moving faster than ever before, so the new business concepts of tomorrow must be developed now. Many creative enterprises are establishing internal teams as “intrepreneurs” to project manage the development of those ideas. This enables seamless integration into normal operations.

Accurate unit cost breakdowns may affect the outcome of any startup concepts of new project initiative. A full cost analysis of the various component will serve to keep the project well on track.

The consolidation of the project requires the business plan to capture financial planning data. Ultimately this can reflect the likelihood or the ongoing feasibility of the project. As much of the data is based on projections (actuals financial data cannot be included prior to market implementation) variance considerations may need to be built into the plan.

Even the most mature organisations may not commercialise their projects appropriately. Should they finance any projects internally, or is there a case for raising external funds to manage the revenue flow separately to existing business processes. The financial member of any innovation team is best positioned to provide funding options or scenarios.

The most successful innovators work effectively across the business enterprise and need to develop additional skills. Communication, problem solving and creative thinking must be skills that all of the creative or innovation team develop. Any project that doesn’t work cohesively will not achieve the desired result.

Australia is competing well in the innovation stakes and currently sits 7th in the global entrepreneurship rankings. All estimates suggest that innovation and entrepreneurship will be driving job growth over the next 5-10 years.

According to data analytics firm Boundlss, 25% of the Australian economy is likely to be directly impacted by software by 2025, which equates to $524 billion of GDP. More importantly, 5.5% of the Australianneconomy, or $115 billion in direct revenues, could be captured by software companies by 2025.

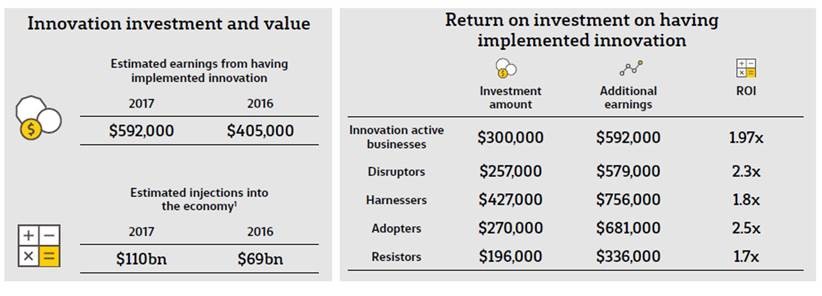

“According to the second annual CommBank Business Insights Report, a major research study of innovation practices and performance of Australian companies with two or more employees and an annual turnover of greater than $500,000, businesses are realising a return of approximately two dollars for every dollar invested in innovation.

On average, businesses that have invested in innovation spent $300,000 in the past 12 months on these activities. And the revenue gains and costs saving derived from investment in innovation has jumped 46 per cent from the previous year, to an average of $592,000 per business. This equates to a Return on Investment (ROI) multiple of 1.97.”

Note, that the same principles apply whether establishing a start-up business or refining a new business concept within an existing operation

There are Higher Education courses that can enhance those skills. There are universities like RMIT and Swinburne that offer post graduate degree programs in Entrepreneurship. However, one can start to sharpen these skills by undertaking a one year diploma program at Melbourne based Acknowledge Education.

About the Author

Cyril Blyth is a Senior Sales and Marketing Manager at Acknowledge Education which provides the one year Higher Education Diploma of Creative Enterprise. You can connect with him on LinkedIn www.linkedin.com/in/cyrilblyth/ or on the http://www.acknowledgecreativity.com/ website.